After the company receives money from the customer, it is often asked to fill out the W-9 form. So what is the main function of the W-9 form? At the end of the year, the customers need to fill out Form 1099 to declare personal income tax, and the expenditure part is required to be declared according to W-9. That is to say, for customers, it can be used for a personal income tax deduction.

You'll probably fill out a W-4 when you start a job, but if you are a contractor or self-employed person, the income tax will be different. Do you know how to fill out a W-9 form? Keep reading to learn how to properly fill out a W-9 template.

Part 1 - What Is A W-9 Form?

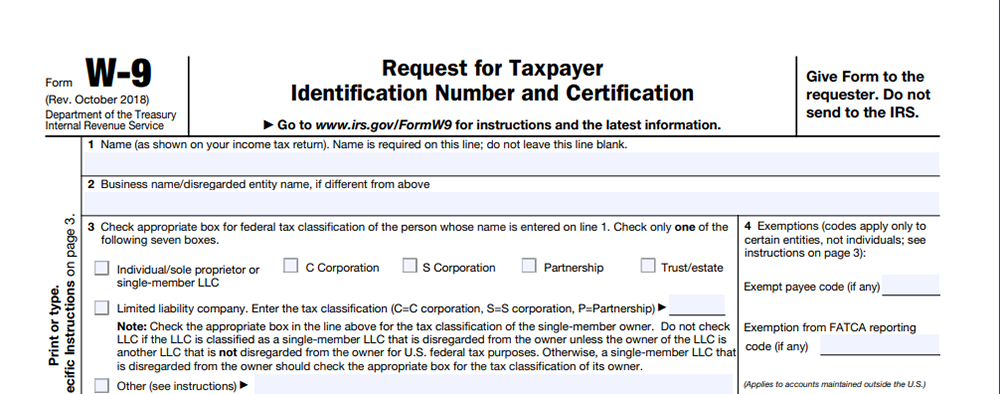

If you were hired by someone as an independent contractor or received certain types of income, you would have to fill out a W-9 Form. Form W-9 (officially, the "Request for Taxpayer Identification Number and Certification") is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service. It requests the name, address, and taxpayer identification information of a taxpayer.

However, who needs to fill out a W-9? The W-9 form should only be filled out by what the IRS calls a "U.S. person". When you are a U.S. citizen, a U.S. working person, or a self-employed person with a U.S. company, you need to fill out a W-9 form after receiving the money from the guest. This form will serve as proof of your own income and the other party's expenditure.

Note

"The term "U.S. persons" doesn't just refer to "people." In legal terms, a U.S. person can be an individual, as long as he is a U.S. citizen or legal resident. It could also be a corporation, an association or company, or an estate or trust organized under the laws of the United States. Foreign estates are not "U.S. persons.""

Part 2 - How to Fill Out A W-9

If you're an employer, or even just making a payment to a vendor, you must generate an IRS form W-9, Request for Taxpayer Identification Number and Certification. You can download the W-9 form from the IRS website. Next, we will guide you step by step to fill out the W-9 form correctly.

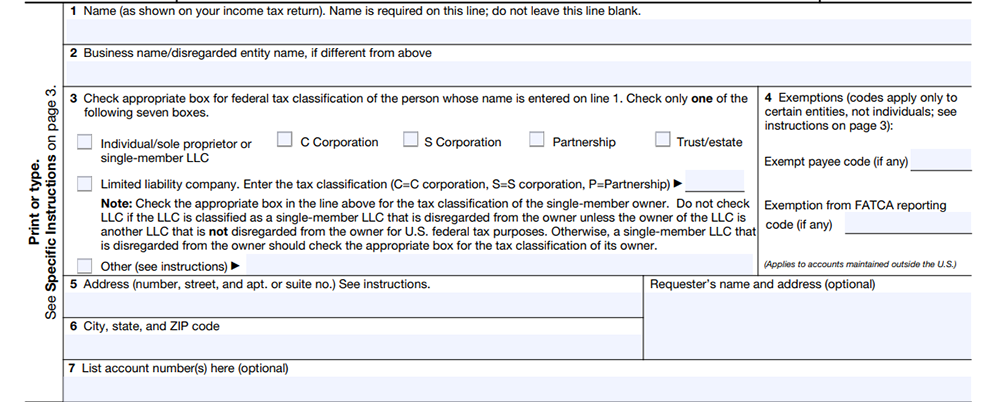

Step 1. The first part of the form will ask for your personal details. In this section, please provide detailed information, including your name, country, and postal address. Please make sure you provide your complete address, as they will use this address to send you a copy of the 1099 form, which is a summary of your US income for the year.

Note

"Just Box 7 is optional. Only fill in this section if you have an account number that your employer will need."

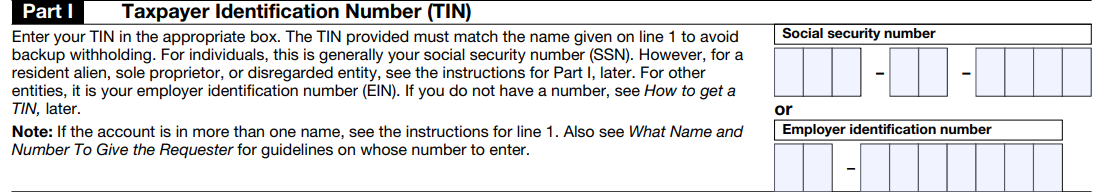

Step 2. In this part, you need to fill in your tax number type (SSN or EIN) and tax number. Fill in the sections that apply to you and make sure to enter only one number in each box. Please make sure you provide the correct SSN or EIN number, because the IRS may impose a fine for the wrong SSN or EIN.

Note

"For individuals, this is generally your social security number (SSN). However, for a resident alien, sole proprietor, or disregarded entity, type or write your Taxpayer Identification Number."

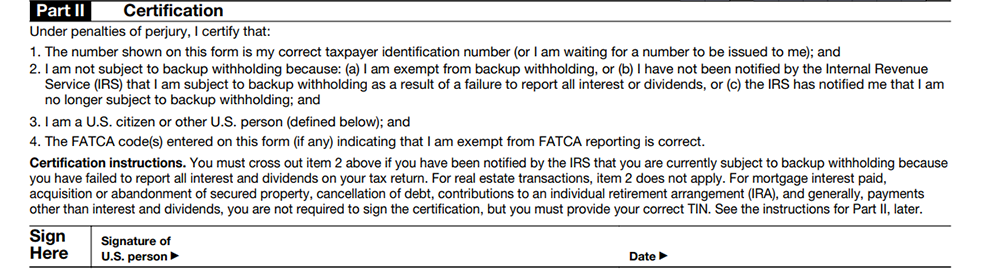

Step 3. In part II of the form, you need to prove that the information you provided is correct before you sign form W-9. If everything is correct and you have read the certification information, you also need to provide your name as an electronic signature. Only sign if everything is accurate.

Note

"Please make sure that you understand all the items under this section. The purpose of Form W-9 is to determine your identity as an American. It is worth noting that providing false information will be punished by perjury."

Step 4. Remember to keep copies of the completed W-9 form. The payee and the payee need to keep one copy each.

FAQs

1. Can I fill out a W-9 form online?

You can download the W-9 form from the above link then go to the "Edit PDF" in EasePDF to upload the file you want to fill out. Then click the "Add Text" icon on the first line. Then you can add your text and drag it to the proper place you want. You can read "How to Fill out A PDF Form" to learn methods step by step.

2. Do I have to pay taxes if I fill out a W-9?

Contractors who receive money under a W-9 don't have any automatic withholding, but they're still responsible for paying income tax. The IRS requires most contractors to estimate their income tax amounts and make payments to the IRS on a quarterly basis. Quarterly tax payments can be avoided if your income is less than USD6,000 a year.

3. Can I refuse to fill out W-9?

Sure. If you refuse in response to a legitimate request, your client will withhold taxes from your pay at a rate of 24%. The accounting department might also find your pain and tell your contact to refuse to do further business with you. Businesses have a heavy obligation from the IRS to obtain a completed Form W-9 from anyone they pay USD600 or more to during the year. Failure to comply can result in fines.

Conclusion

It is necessary to learn the W-9 template. After reading this post, you can know how to fill out the W-9 form step by step. If you still have questions about the W-9 template, please contact us.

Was this article helpful? Thank you for your feedback!

YES Or NO